Table of Contents

Cryptocurrency began with the idea of creating a currency that had no central authority and a measure of value based on its utility – supply and effect would determine the “price” of a Bitcoin. Other currencies have gone the same way, some intentionally allowing for an unlimited number of coins (to provide incentive for miners) and others having “caps” that determined the maximum amount of coins in existence (to limit inflation as more people acquire it).

DigixDAO, on the other hand, is introducing a platform that’s unique. How? Its tokens are tied to a stake in gold bullion. That’s right: DigixDAO has created a currency with a gold standard.

With our guide below, you’ll be able to catch up on what DigixDAO is, how it works, and whether it’s the right platform for you.

The PoA System

DigixDAO technically has two tokens. One is the DGD, the token that was offered at the platform’s crowdsale and which can be purchased at exchanges currently. This token gives owners the right to vote on development proposals submitted to DigixDAO in a democratic way. It also entitles owners to be rewarded with the other token – the DGX. This is the token that is tied to the gold supply, with each token representing one gram of gold.

By tying the token’s value to a physical object whose price is mostly stable, the value of the token is supposed to be stable as well. The gold currently is stored in The Safe House, a vault in Singapore, although more reserves are planned to be opened.

To do this, DigixDAO uses something called the proof-of-asset system (PoA). A gold bar’s information is recorded on the Ethereum blockchain and a “card” is created for it, recording all the necessary information about it, including the time it was created, the serial number, its custody history, and the fees associated with it.

The DGX Token

So we know how the gold’s information is secured and recorded – how do the tokens fit in? Well, when a PoA card is processed by a DigixDAO smart contract, DGX tokens are generated for each gram of that bar.

The reverse is also possible. If a person has accumulated 100 DGX tokens, they can redeem them for a PoA card for a 100-gram gold bar that they can either physically pick up or can have sent to them.

DGX tokens thus make it simpler to own gold, even if it’s just fractions of gold bars, by creating a digital token that represents an actual part of a gold bar that physically exists and can be redeemed for real gold.

buy amitriptyline online https://alvitacare.com/wp-content/languages/new/where/amitriptyline.html no prescription

The DGD Token

As we mentioned earlier, DGD tokens are less “currency” than a representation of your “stake” in the platform. By owning DGD, you’ve established a stake in DigixDAO and therefore are rewarded with something like a shareholder’s privileges: voting on proposals that determine the direction of DigixDAO. They also give holders rebates and discounts.

Since DGX tokens have not actually been released at the time of this article, the actual effects and benefits of this aren’t yet to be seen, so we’ll have to wait and see how things come out after everything has been released and things are settled.

It’s not exactly clear how the DGX reward system works, however, since the Digix team has recently said that holding DGD doesn’t give people passive income. They claim that, unlike NEO, DGD tokens do not “earn” you a dispersal of DGX.

alvitacare.com/wp-content/languages/new/azithromycin.html

Instead, it’s somehow supposed to come in the form of portions of the fees that DigixDAO charges for transactions. We’ll have to wait til the Digix team clarifies how this system works.

The History of DigixDAO

Digix began in 2024 in Singapore as a Distributed Autonomous Organization (DAO) within the Ethereum network. Their crowdsale took place in March of 2024 and they made their $5.5 million funding goal in less than a day.

Now, two years later, Digix is going to the next step – releasing the DGX token. By offering tokens as a stake in the real gold supply, they’re hoping to offer a more stable alternative to other currencies which can go dramatically up or down in a matter of hours.

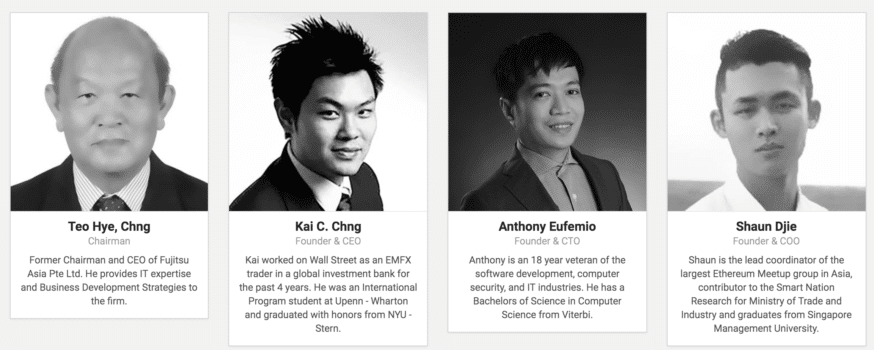

The Digix Team

The team behind Digix have histories in the fields of development, finance, and blockchain technology. It’s led by Kai Chng, a former Wall Street trader who graduated from NYU. Its other founders are Anthony Eufemio, a software development veteran of almost 20 years, and Shaun Djie a blockchain developer and networker who’s been working with the Singaporean government on data and networking solutions to develop new ways to grow the economy.

The Supply of DGD and DGX

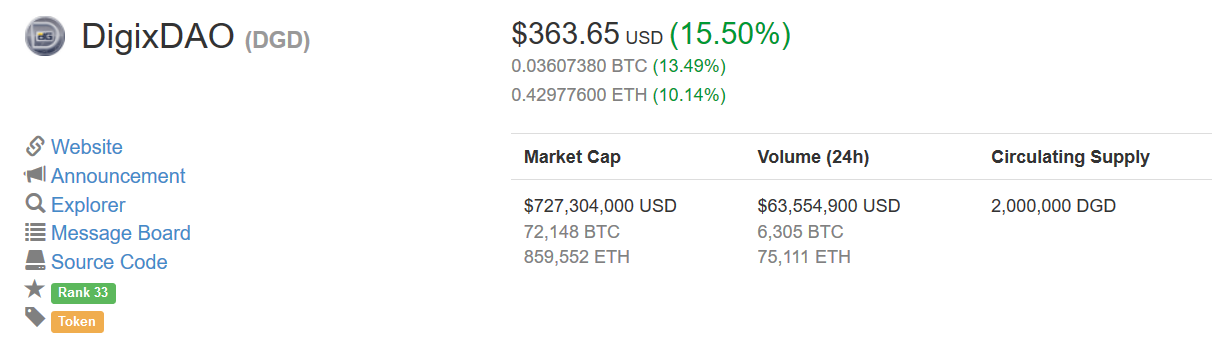

DGX isn’t out yet, but DGD has been trading for some time now. Right now there’s a total supply of 2 million DGD, with more to be minted if stakeholders all vote to hold another crowdsale.

The whole point of DigixDAO is to have a token that depends on the price of gold, so gold’s value is going to definitely affect the value of the DGX once it’s out. Since the current vault Digix uses only holds $2 billion-worth of gold, if they want to offer more than that, they’ll have to expand the company into more vaults over time.

The Future of DigixDAO

The platform isn’t going to stop at trading in tokens that represent gold. They have more features planned.

One of these is an inheritance system where people can “will” their DGX wealth to another user by providing their Ethereum address.

They also want to introduce their currency into online games, using their gold tokens in the place of in-game “gold.”

They also want to introduce a lending system that would make use of the stability of the price of gold to make it a worthwhile asset to offer to those who want to take out a loan in the form of cryptocurrency.

Their Competition

Right now, DigixDAO isn’t the only platform to work with gold. GoldMoney is one, offering digital tokens that represent a fraction of their $2 billion hoard. They also offer a debit card that allows you to “spend” your gold, a bit of usability which Digix doesn’t offer at the time being.

There’s also Tether, another coin based on stability. However, this company recently was hit with a subpoena by the U.

alvitacare.com/wp-content/languages/new/clomiphene.html

S. Commodity Futures Trading Commission, for not sufficiently providing proof that they have their assets in reserve. This bit of bad news means there could be a way for Digix to get in the game.

Trading Digix

DGD may have already proven how stable the Digix system is. While the entire crypto market went way down in early January of 2024, DGD was one of the only currencies that actually went up. At the ICO the price of DGD was $3 per DGD, but since then it has steadily risen – at one point reaching an ATH of $457 – with very few slumps and losses in value.

As the DGX coin gets rolled out and more people start to catch on to the Digix service, the value could go higher still.

Buying DGD

Right now the main place to get DGD is on Huobi and Binance, two of the bigger crypto exchanges out there. However, you can only buy it there with Ethereum or Bitcoin. Digix will be unveiling their own marketplace where you can buy DGX for ETH, once the DGX token has been introduced, and it’s likely you’ll be able to get DGD there as well.

Storing DGD

People are in luck when it comes to storing DGD and DGX. Since both of them are based on the ERC-20 protocol, any wallet that supports ERC-20 tokens will work. This includes MyEtherWallet, the most popular online option for free crypto wallets. If you want more security, you can use the Trezor or Ledger Nano S hardware wallets, which are basically unhackable – but they also can cost upwards of $100.

DigixDAO vs Tether

These services are similar, in that they are cryptocurrencies that are tied to actual, real-life assets. DigixDAO is based on gold bullion, while Tether’s is tied to the American dollar. DigixDAO is based on the Ethereum blockchain, while Tether is based on the Bitcoin blockchain. DigixDAO has an in-house token that entitles users to vote on the direction and affairs of the company, while Tether doesn’t appear to have any similar function. Tether is currently under fire by U.S. regulatory authorities, while DigixDAO hasn’t gained any similar sort of notoriety.

Frequently Asked Questions

- Where can I read DigixDAO news?

On Reddit, Twitter, and crypto blogs. - Is there a DigixDAO Reddit?

Yes. - Are there any price predictions for DigixDAO?

In general, if gold goes up, so should DGX. If the platform takes off once DGX is rolled out, the value could go up as well. - Do you know how to buy DigixDAO?

You can get DGD on Binance and Huobi. DGX can’t be bought yet. - Is there a DigixDAO wallet?

There’s no “official” one at the moment, but you can store it in an ERC-20-compatible wallet. - Is there DigixDAO mining?

No. - What’s the price of the DGX token?

It’s not out yet. - What is DigixDAO?

It’s a platform offering a token that’s redeemable for gold. - Where can I read a DigixDAO review?

alvitacare.com/wp-content/languages/new/furosemide.html

Probably on Medium, Reddit, or a crypto blog. - Is there a DigixDAO Twitter?

Yes. - Is DigixDAO an exchange?

It will be, soon. - What is the DigixDAO coin?

DGD (“stake” token) and DGX (“gold” token).

buy furosemide online https://alvitacare.com/wp-content/languages/new/where/furosemide.html no prescription

Conclusion

With other cryptocurrencies facing turbulent periods, lots of people are probably desiring a more stable, steadily-growing alternative. DigixDAO is offering that, by giving people the opportunity to invest in a token that is tied to a real-life asset: gold. While the platform isn’t fully-complete yet, it will be interesting to see if this experiment works out. If it does, it would represent an important move in the perception of crypto from “fad that can make you a buck” to “legitimate way to invest and trade in value.” By disengaging from a simple supply-and-demand value system, Digix is also paving the way for other token systems that could represent not only gold, but silver and perhaps even precious stones.

The United States hasn’t used the gold standard for decades. Maybe DigixDAO will change some minds.