Table of Contents

As blockchain platforms have become more diverse and numerous, a serious problem has developed: how do you efficiently transfer and exchange assets from one system to another? Yes, we have exchanges, but you don’t always find the right trading pairs, and trading one currency for another, just so you can get that currency traded for yet another, and all while signing in to multiple accounts can just be exhausting. That’s where Wanchain comes in. This platform is its own blockchain, and what it’s supposed to do is to link different chains so you can quickly trade currency and other digital assets from one to the next.

Feel free to use our guide below for more information about Wanchain, the Wanchain token (WAN), how the platform works, its development, and how it can help you. And if you find this article helpful, check out our new list of the best altcoins of 2024, where we go in depth to find which ones are the best investment opportunities.

Wanchain: How It Works

Despite being based off of Ethereum, Wanchain is its own separate blockchain. This is so that it can more readily provide the cross-chain protocol that makes up the primary purpose of the platform.

Here’s how it works.

Verification nodes make up how the system works. They essentially run the processes that deal with each transaction, and confirm whether a transaction should go through or not. They’re run by three types of users.

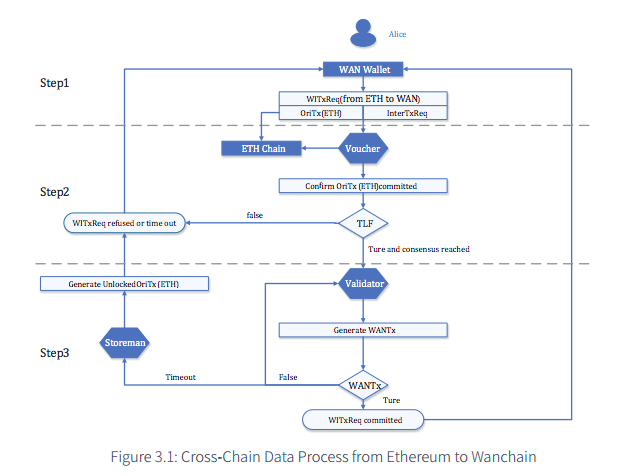

First, let’s talk about the cross-chain protocol itself. What this is is the way that data can be transferred between other blockchains and Wanchain.

buy levaquin online cpff.ca/wp-content/languages/new/mg/levaquin.html no prescription

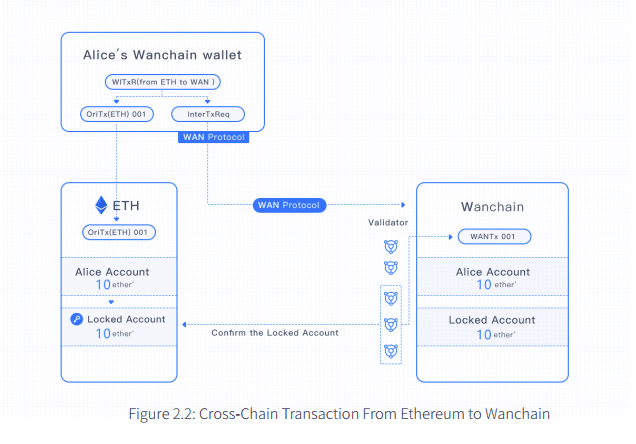

It’s made up of three things. First, there’s the registration module, which is the part that marks the chain that the transaction comes from, and what’s being moved as a part of the transaction. Then there’s the cross-chain transaction data transmission module, which not only informs Wanchain of the transaction request, but also starts the transaction from the “validator node” to the initial chain. Lastly, there’s the transaction status query module that makes sure the transaction is going as planned.

First, there are vouchers that get a portion of the transaction fee in return for a proof of transaction. If that proof doesn’t match up and comes back false, their security deposit is withdrawn and they don’t get to authorize any more transactions.

There are also validators that record transactions in the blockchain. For this, they get a part of the fee.

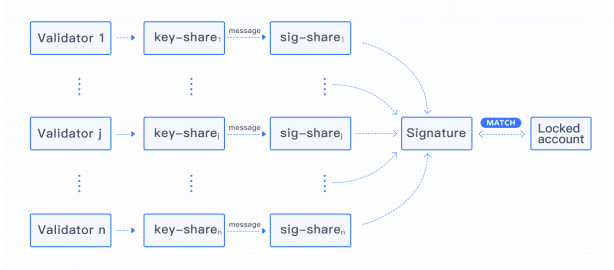

Finally, there are storemen who maintain “key shares” for a portion of the fee.

By having individuals run nodes that process transactions, the system is distributed (making it harder to cause large-scale damage) and user-driven, dividing the processing power and giving people a stake in the platform by performing services (hosting nodes) for which they can be rewarded.

The locked account generation scheme keeps keys and funds secured when there are several parties involved in a transaction. This means that when several people have access to an account, they each have a portion of a key. That means one person won’t be able to loot an account for their own benefit, as a majority of users will need to enter their keys at the same time for the funds to be available.

The WAN is the platform’s token. These tokens are used to pay for each transaction, and are used for the “security deposits” for the cross-chain verification nodes. There are about 215 million WAN in total.

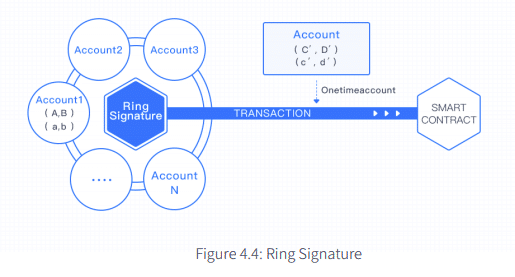

The platform uses one-time addresses for sending and receiving assets so that senders and receivers can be kept anonymous. Once a transaction is done, the address is defunct and thus no more connection between sender and receiver. Ring signatures make things more anonymous by mixing up your signature’s point of origin with others, making you hard to trace.

The Wanchain Team

This organization is a non-profit, oddly enough, and they’re based in Singapore. It was founded by Jack Lu, a blockchain developer, and Dustin Byington, who founded Bitcoin College and Satoshi Talent (a service that connects developers and entrepreneurs).

After Wanchain was launched, the team drew up their plans for the future. Later in 2024 they’ll be adding Ethereum cross-chain trading, a wallet that handles multiple currencies, and Bitcoin interactivity.

While there are other projects like Stellar and Ripple that also aim to bridge connections between blockchains, it’s the only one to include privacy protocols like one-time addresses, so that contracts

can be done anonymously.

Where Do I Trade and Buy Wanchain?

This project is brand new. As such, Wanchain isn’t available for trading. Only people who got in on the initial coin offering (ICO) have WAN.

Interestingly, since Wanchain’s blockchain wasn’t accessible during the ICO, Wanchain offered ERC-20 tokens to investors that they can now redeem now that the system is up.

But watch out: if you buy one of the WAN ERC-20 tokens on a service like EtherDelta, be aware that you’re not buying actual WAN. And since those tokens, once traded, have no value (as trading them violates the TOS) you can’t exchange them for WAN.

So don’t be fooled. Wait until the WAN is officially traded on an exchange. If you’re impatient, though, and want a new coin to invest in now but don’t know where to start, start with our new list of top picks for the best altcoins of 2024.

Where Do I Store Wanchain?

Like most new currencies, Wanchain has its own official wallet, which is available for Mac, Windows and Linux. If you got in during the ICO and have traded in your tokens, you can store WAN in that wallet. While the wallet only allows WAN for the moment, the next release of the platform is supposed to include support for other currencies too.

Wanchain vs ICON

These platforms are a little similar, but only broadly. Both aim to connect different financial systems, but aside from that, they’re very different. Wanchain is a platform for linking different blockchains and transmitting assets from one to another, while ICON is a blockchain project that’s supposed to link everything together – from banks to businesses to the government – so that any and all parties can interact securely without needing third-party networks. Wanchain wants to be used worldwide, while ICON is limited to South Korea only.

Wanchain vs Ripple

While Wanchain is a service that is supposed to connect different blockchains for easy transactions between them, Ripple is a currency exchange that’s supposed to allow for different assets to be exchanged quickly. They don’t have much in common, except for the fact that they’re based on decentralization as a core principle, so that the service works “on its own” without being managed by a central company or group of people. Wanchain is brand new while Ripple has been around since about 2024, with the third-highest valued coin in the crypto market.

Wanchain vs Ark

Here, we have two similar ideas: linking blockchains. Wanchain wants to be a go-to for performing transactions across blockchains, and Ark wants the same thing. Wanchain offers users the option to operate nodes that perform the transactions between other users for a reward, while Ark has a dedicated delegates that run the network. Ark has also offered its code to anyone who wants to develop their own blockchain, while Wanchain doesn’t seem to have anything similar on offer.

buy cymbalta online cpff.ca/wp-content/languages/new/mg/cymbalta.html no prescription

Ark has also been around slightly longer, while Wanchain’s tokens aren’t even being traded in the exchanges yet.

Frequently Asked Questions

- How do I buy Wanchain?

Right now, you can’t buy it on an exchange yet. Once the platform becomes fully operational, you will be able to. - What is the Wanchain coin?

It’s called WAN, and it’s a token that’s used to pay for transactions performed on the system. - When was the the Wanchain token sale?

October, 2024. - What is the price of Wanchain?

There is no price, because it’s not being traded right now. - Is Wanchain an exchange?

It is, of sorts. It’s supposed to be a bridge between blockchains so that you can transfer and trade assets directly, without the need for an exchange. - Is there a forum for Wanchain on Reddit?

Yes. - What is the Wanchain release date?

Sometime between January and June 2024, most likely. - Can I buy Wanchain on Binance?

Not at the moment, but it could end up trading on Binance eventually. - When will Wanchain hit exchanges?

It’s not clear exactly when, but likely in the first half of 2024. - Can I buy Wanchain in the ICO?

The ICO was in 2024, so you’re out of luck. - Does Wanchain have a Twitter?

Yes.

- Is Wanchain on EtherDelta?

Currently no. What’s trading there is the Wanchain ERC-20 token, but you shouldn’t buy it. Why? It’s not supposed to be traded for anything other than WAN, meaning if you get it from there, it’s already worthless since the ToS were broken. - What is Wanchain?

It’s a decentralized platform that connects different blockchains together with smart contracts built on privacy and anonymity. - Do you know how to buy Wanchain?

You’ll be able to buy it once it goes on the markets.

Conclusion

Wanchain is not the first project of its kind. There are other platforms that want to bridge connections between blockchains for more efficient trading and exchanging of assets, but Wanchain offers some things that are new. One, everything is decentralized, with users running nodes of the network themselves, and it uses privacy and anonymity as the fundamental basis of its smart contract system. It’s brand new and can’t even be bought or used yet, but 2024 may end up being a good year for them.

buy synthroid online cpff.ca/wp-content/languages/new/mg/synthroid.html no prescription

We’ll have to wait and see.

If you like Wanchain’s features but want to compare them to other hot new coins, check out our list of 2024’s best new tokens, currencies, and coins.