Table of Contents

- 1) The KuCoin Share

- 2) The Features of KuCoin Shares

- 3) How KuCoin Shares Work

- 4) KuCoin’s Interface

- 5) KuCoin’s Team

- 6) KuCoin Shares: Sustainability and Supply

- 7) Trading History of KuCoin Shares

- 8) Buying KuCoin Shares

- 9) Storing KuCoin Shares

- 10) KuCoin Shares vs Binance Coin

- 11) KuCoin Shares vs Coss

- 12) KuCoin Shares vs KuCoin

- 13) Frequently Asked Questions

- 14) Conclusion

With the growth of cryptocurrency has come a rise in crypto exchanges, including heavyweights like Binance and Bittrex. Now, those platforms have a new challenger: KuCoin.

Based in Hong Kong, KuCoin has quickly risen to be one of the most broad trading platforms on the market, with 210 digital currencies and tokens supported. Despite only having been released in late 2024, it’s already the 19th biggest exchange in the crypto community, with enormous growth in a short amount of time.

While it shares some similarities with other exchanges, there’s on element in particular about KuCoin that’s unique: the KuCoin Share, the native token that not only allows you to pay less in trading fees, but entitles all users of the platform to their share of the 50% of all KuCoin revenue that the team redistributes to users.

Learn more about KuCoin and the KuCoin Share by using our handy guide below. And while you’re in the neighborhood, don’t forget to check out our list of 2024’s best altcoins.

The KuCoin Share

Like many exchanges, KuCoin has their own “token,” called the Share (KCS). As we mentioned above, KuCoin rewards users who possess KCS by giving them a cut of the platform’s trading fees, in essence “rewarding” them for how successful the exchange is. If you have more KCS, you’ll get more of a payout.

What this means, essentially, is that users can earn passive income just by possessing KCS. While the total amount shared with users is 50% of revenue, keep in mind that this is only for the moment: the total amount will go down in the future.

Payouts happen every day, and they come in the form of whatever coins are being traded: Bitcoin, Dragonchain, or any of the other 210+ coins that are being traded on the exchange.

The Features of KuCoin Shares

In addition to earning a share of whatever trading fees have been collected by the platform that day, there are other features as well.

For example, if you have KCS, you’re entitled to a discount when you trade and when you withdraw. If you have a large number of KCS you can also qualify to receive consultations from investment advisers and quicker customer service. Since it’s an ERC-20 token, KuCoin Shares can be stored in wallets that work with the ERC-20 protocol, including Trezor and Ledger Nano S.

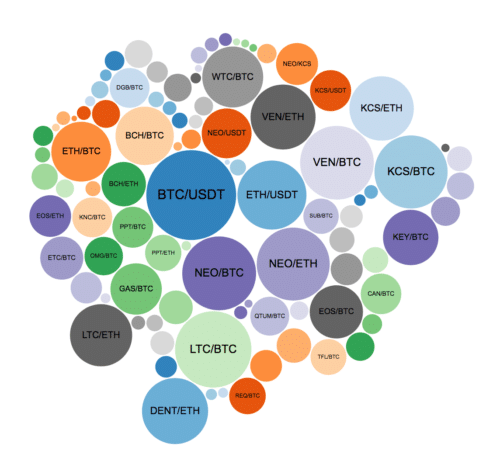

KuCoin itself also comes with lots of good features, including low trading fees overall, lots of different trading pairs (including Bitcoin, Ethereum, and NEO) and high security. There are also fewer lags due to a powerful, streamlined engine that powers the network.

How KuCoin Shares Work

The overall details of the distribution of KuCoin Shares are in the KuCoin whitepaper. Here, we’ll distill the overall metrics.

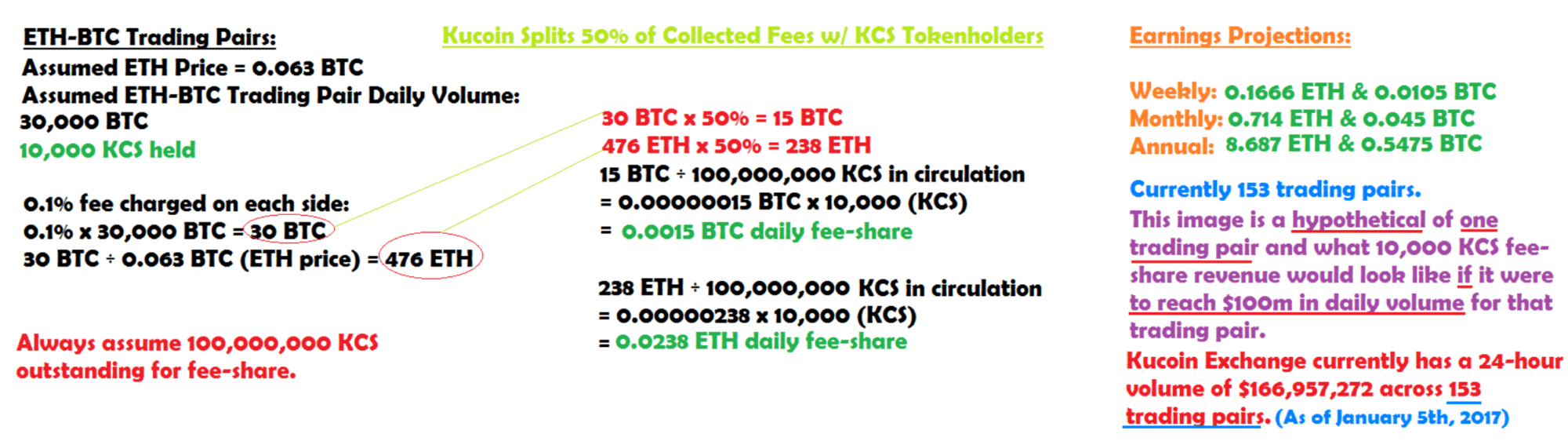

As we mentioned earlier, the distribution depends on how much KCS is in a user’s wallet. More detial is shown in the below image:

So for someone who has 10,000 KCS (or $80,000 as of early February), they would earn .00015 Bitcoins per day, .045 Bitcoins per month, and .5475 Bitcoins a year. If the exchange is a Bitcoin and Ethereum trading pair, you would earn a commensurate amount of Ethereum as well.

That’s right. You don’t only earn one kind of currency from these dividends, but both currencies used in any transactions.

Also, if you have 1000 KCS, you get a 1% discount in trading fees, and for every thousand after that you get an addition 1% off (with a cap at 30%). Other great coins that offer discounts can be found on our new list of the best altcoins of 2024.

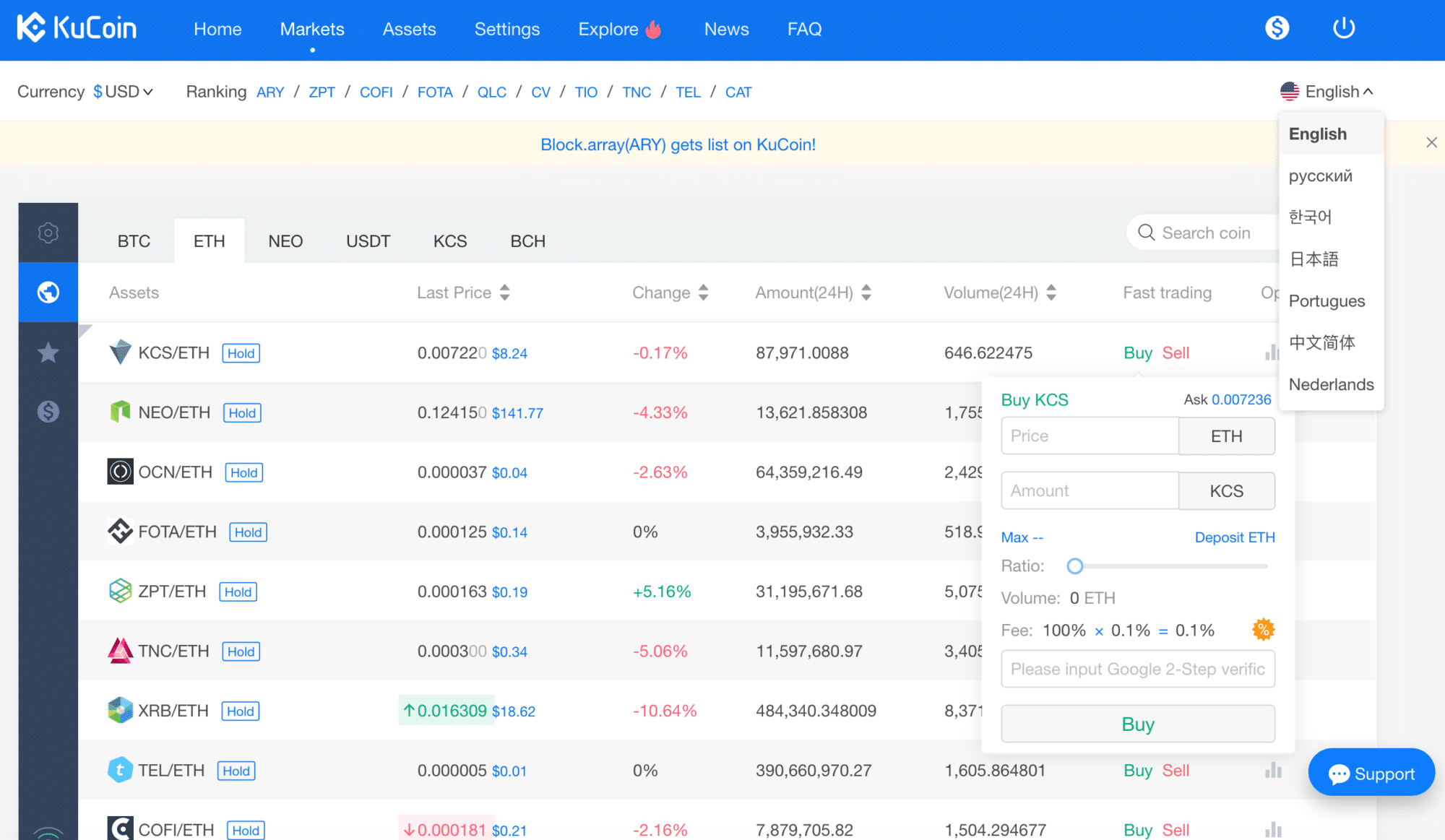

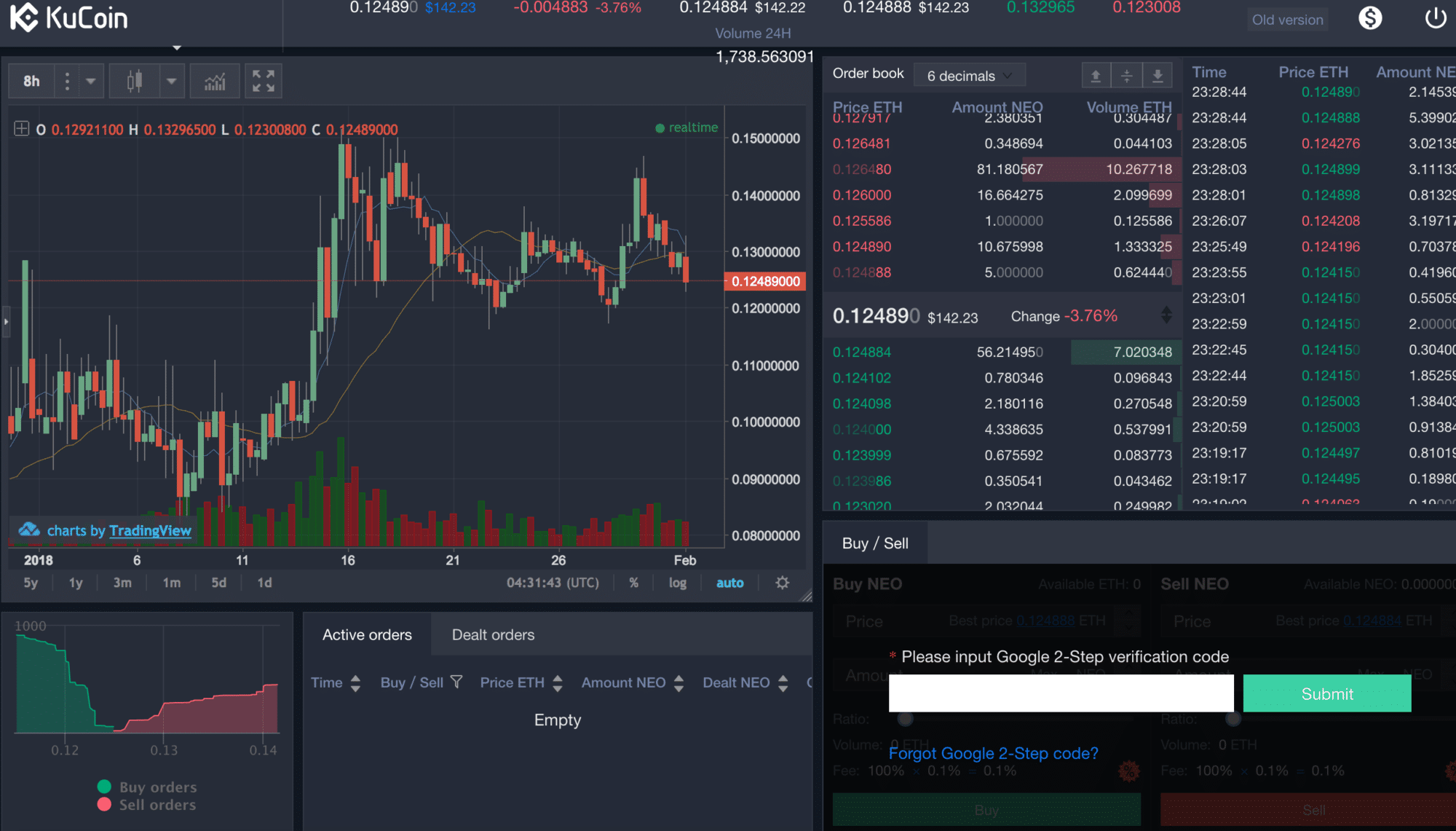

KuCoin’s Interface

The focus of KuCoin’s interface is user-friendliness. That doesn’t mean it’s light on data and information, though: despite being easy to use, it doesn’t skimp on the things you need to make informed decisions, like graphs and charts. The interface comes in many languages including English, Japanese, Mandarin, and Spanish.

Trading is as simple as clicking a button. For new users, there’s a helpful support button that gives you extra tips and information, should you need it.

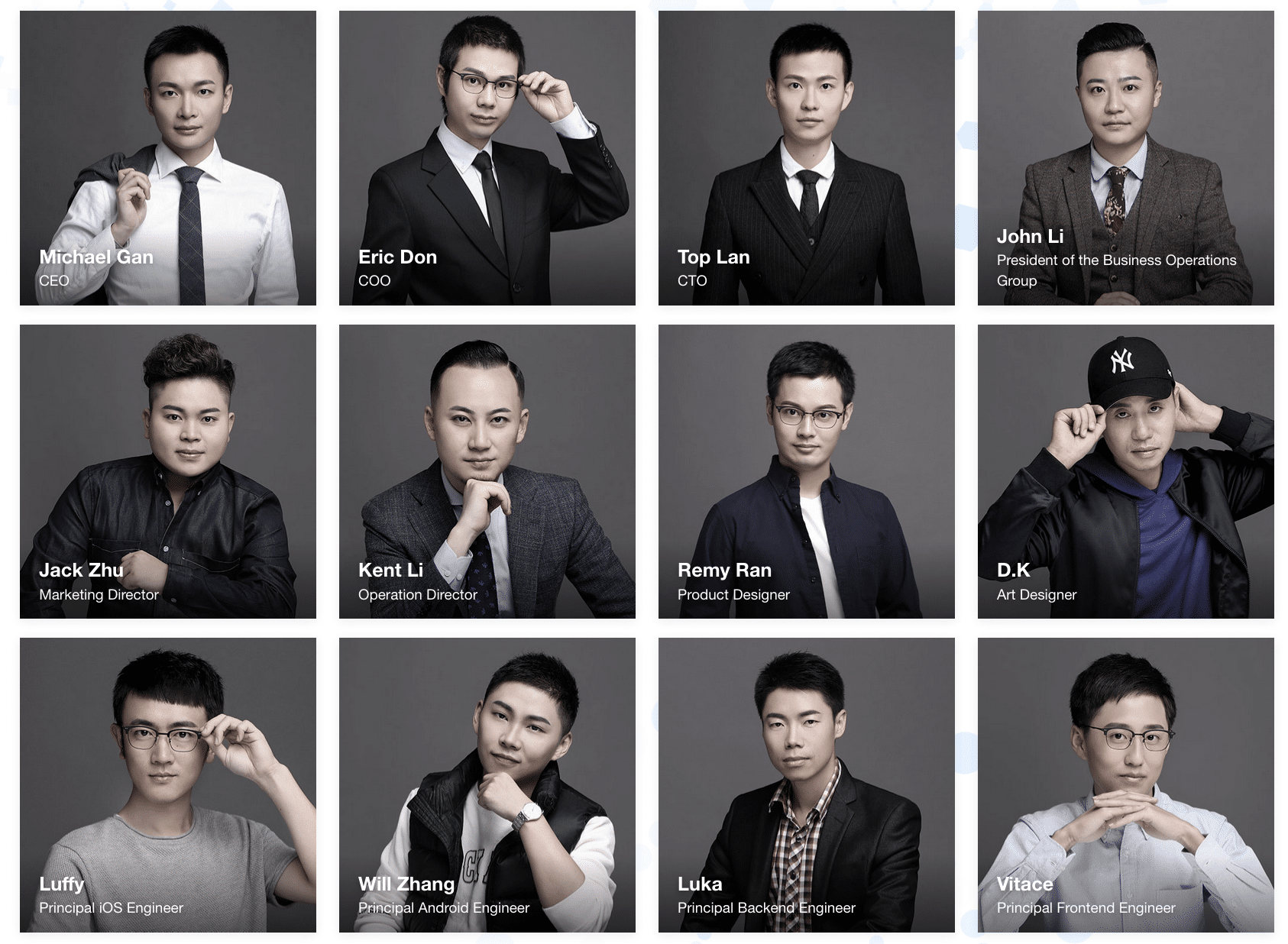

KuCoin’s Team

The team is based in Hong Kong, and has 12 members led by Michael Gam. Gam used to provide technical support for Ant Financial, an affiliate of Alibab, the Chinese e-commerce behemoth. The COO is Eric Don, whose background is less clear: the main website says that he’s a senior partner in multiple companies like “YOULIN” and “KITEME,” but we couldn’t actually ascertain if these companies exist or not, since we couldn’t reach them through an internet browser.

As you can see from the pictures, the team has lots of personality.

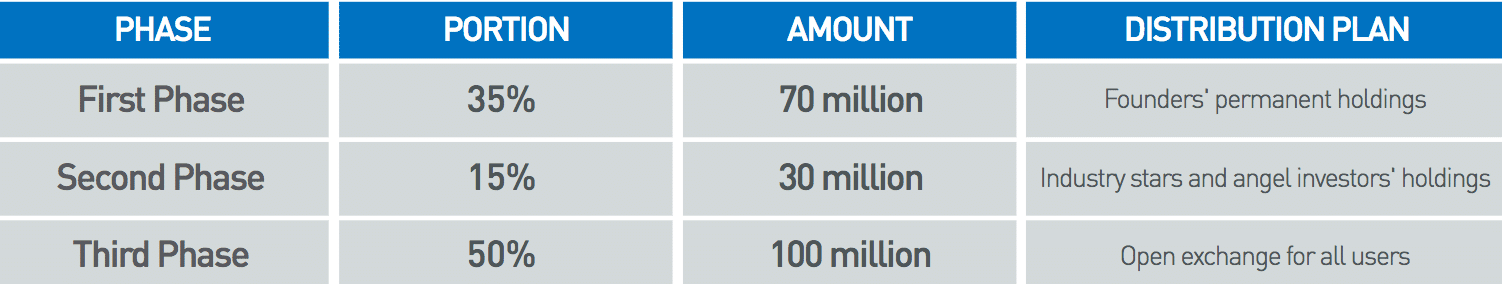

KuCoin Shares: Sustainability and Supply

Right now there’s around 180 million total KCS, with half of that in circulation. Initially they released 200 million KCS, but the team decided to reduce the total amount by buying back KCS with their profits each quarter until they can get the number down to 100 million. This will definitely affect the price going forward.

The company has a distribution plan which can be seen in the graphic below, outlining the team’s intentions:

The founders’ share of KCS is in a “lock-up” period that will last til 2024, during which time they can’t sell off their KCS. By binding their fate to the platform, it shows that the team isn’t just in this to make a quick buck and abandon ship.

The Trading History of KuCoin Shares

The history of KuCoin Shares started in late 2024, when its value was around $0.70. Around the turn of the new year, however, things shot way up: it reached an all-time high of $20, before falling by over half of its value to hover around $8. While some other cryptocurrencies had huge losses around early to mid January, KuCoin was lucky enough to end up falling to a value that’s still higher than many other tokens and currencies, many of which are still less than a dollar.

Buying KuCoin

The main drawback with KuCoin Shares is the fact that you can only buy them from the KuCoin website, and nowhere else. What’s more, you can’t buy it with fiat: you can only by it with other cryptocurrencies, so you’ll first need to put Bitcoin or Ethereum (etc) in your KuCoin wallet in order to get them in the first place. While some may claim that this puts an unnecessary obstacle to new users getting in on KCS, it won’t be a problem for those who already have Bitcoin, Ethereum, or other cryptocurrencies available to them.

Storing KuCoin

On the plus side, since KuCoin Shares are ERC-20 compatible, you can keep them in Ethereum blockchain wallets (like MyEtherWallet). Even better, you can put them in Ethereum hardware wallets like Trezor and Ledger Nano S. This way, you can be even more secure, since with hardware wallets you can have things in “cold storage,” unlinked to the internet, so that there’s no chance of something going wrong.

KuCoin Shares vs Binance Coin

These coins have a lot in common. First off, they’re both ERC-20, meaning they both work on the Ethereum blockchain. Both give users reduced fees when trading on their respective platforms (KuCoin and Binance, respectively), and although both services will be reducing the total amount of discounts users can get, Binance has their plan spelled out (decreasing by 50% each year), while it’s less clear with KuCoin Shares. Both exchanges the coins are used for are crypto-only, meaning you can’t use fiat currency to trade on their platforms.

KuCoin Shares vs Coss

These coins (and their services) are also similar. Coss, like KuCoin, splits 50% of its profits with its users when they possess the native token. Both are young, only having started trading since late 2024. KuCoin seems to be on a quicker trajectory, while Coss seems to be lagging in their development. Lastly, KuCoin is valued much higher – $8 at the writing of this article – compared to Coss’s value at less than $0.50. Both services have their own communities on Reddit, a common place for fans of crypto.

KuCoin Shares vs KuCoin

The distinction here is practically none: KuCoin is the service, KuCoin Shares are the tokens that power it. People use Shares to pay for transactions, and can trade them for other currencies on the exchange. The more KuCoins you have, the more you can earn from the daily distribution KuCoin shares with its users, an amount that currently has no cap. KuCoin Shares’ value depends entirely on the success of KuCoin itself.

Frequently Asked Questions

- Can I read about KuCoin Shares on Reddit?

Yes, there’s an active community there. - How do I buy KuCoin?

You can only buy it on the KuCoin service with crypto. - What is KuCoin?

It’s an exchange that splits 50% of its profits among its users. - Is KuCoin an exchange?

Yes, it’s an exchange where you can trade, buy, and invest in cryptocurrencies. - What is the KuCoin coin?

That’s the KuCoin Share, a token that you can use within the service itself. - Is there a KuCoin app?

Yes, there are apps for Android and iOS. - Are there fees for using KuCoin?

Yes, but they are supposed to be quite low, and can be reduced even further by owning KuCoin Shares. - Do you know how to use KuCoin?

The interface is relatively easy to use. If you have problems, you can use the support button or talk to customer service. - Is there a referral bonus for KuCoin?

Yes, you can earn rewards for referring others to the service. - Where can I read a review of the KuCoin exchange?

You can read reviews on crypto blogs and on Medium as well. - Where is KuCoin based?

The company is based in Hong Kong. - Does KuCoin have a Twitter?

Yes. - Is KuCoin legit?

As legit as any cryptocurrency exchange in existence. - Who would win in a battle of KuCoin vs Binance?

Hard to say, but if you want to read a comparison of the two, check out the section above. - What is the KCS coin?

That’s just the short name for the KuCoin Share.

Conclusion

Things are starting to heat up in 2024 as more currencies and tokens are introduced, and more blockchain companies come out with their own platforms. Users will need a place to exchange one currency for another, and right now KuCoin is one of the few that rewards users simply for having its coin. That, plus a good start of the year, market-wise, puts KuCoin on the road to being one of the most impressive new platforms in the crypto world. Keep an eye on the news and market trends, and your investment in KuCoin might just pay off.

So now you know what KuCoin’s about – but what if you’re looking for other great coins, and don’t know where to start? We’ve made it easy: here are our picks for the best altcoins of 2024.